Getting The Insurance To Work

Unknown Facts About Insurance

Table of ContentsGetting My Insurance To WorkAll About InsuranceHow Insurance can Save You Time, Stress, and Money.Insurance - An OverviewThe 15-Second Trick For InsuranceInsurance for Dummies

If you're travelling to the United States you will require added clinical cover just how old you are. Traveling insurance coverage can set you back even more if you're over 65.You might be able to keep prices down. If you're a UK citizen and have a European Health And Wellness Insurance Coverage Card (EHIC), you can still use it to get medical care in EU countries up until it expires.

You ought to still obtain take a trip insurance coverage before your journey - even if you have an EHIC or GHIC. Examine if your family components insurance plan covers you for products you eliminate from house. If it does, you could pick a larger on your travel insurance plan. The unwanted is the amount that your insurance provider will not pay out for the case as well as is normally between 50 and also 100.

Insurance Fundamentals Explained

The cheapest plan might not offer finest worth for cash, so it's essential to examine what the policy includes in addition to just how much it sets you back. You can check what different plans use and also just how much they cost by utilizing an on-line contrast website. Contrast websites usually only provide general cover.

Along with these benefits, Allianz Global Assistance provides 24/7 support with emergency health center care plans, emptyings for medical emergency situations, changing lost or taken documents, and also a lot more.

The Greatest Guide To Insurance

Furthermore, travel policies with medical coverage may cover any diseases or hospitalizations that happen during a journey, but you require to assess your plan to see if your plan is just one of them. Ask on your own: What are the possibilities you'll be affected by severe weather or another occasion? Just how ready are you to take dangers? Exactly how much are you willing to pay for a back-up strategy? Do you have doubtful health and wellness or is a liked one ill? If you can not afford to terminate and also rebook your trip or your health insurance does not cover you abroad, you must consider travel insurance.

Some Known Details About Insurance

Travel insurance policy does not cover anything relevant to a pre-existing problem but limits for pre-existing conditions that do not relate to emergency medical emptying or repatriation. If you have a pre-existing clinical condition, it is essential to obtain the protection you require to be risk-free on your journey. There are plans available for pre-existing conditions so speak with your insurance policy company to locate the finest strategy for you.

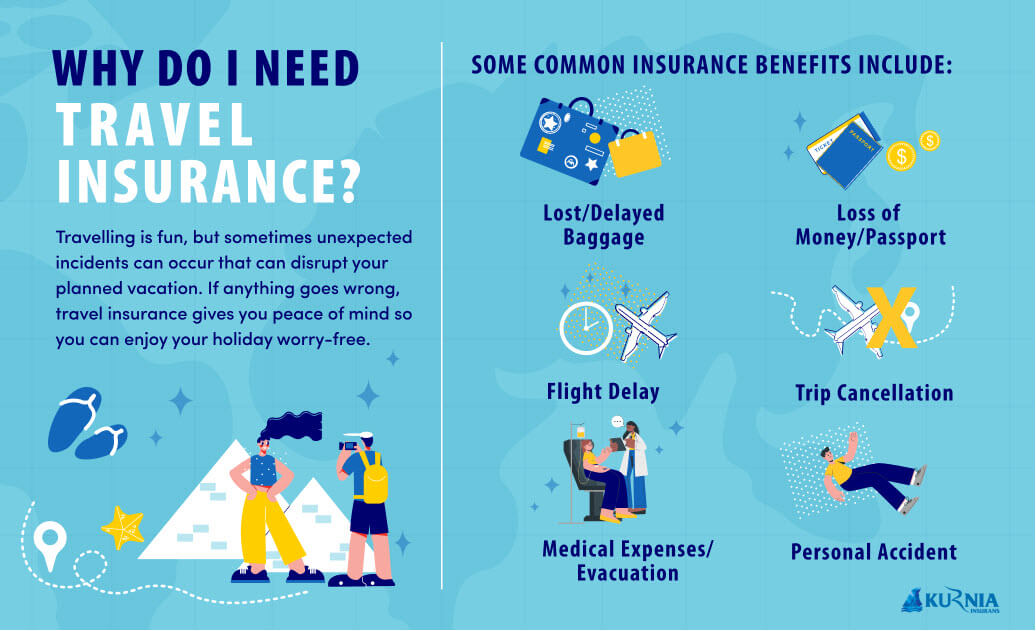

If you're intending to travel, there are many reasons that traveling insurance policy might be ideal for you: You'll understand you're secured in situation of a mishap or sudden illness. The cost of clinical treatment can be much higher abroad than in Canada, They'll see to it that you have accessibility to clinical care and schedule you ahead residence if needed.

Travel insurance policy is a kind of insurance coverage that covers the costs and losses related to taking a trip. It is helpful protection for those taking a trip domestically or abroad. According to a 2021 survey by insurance provider Battleface, try here practically fifty percent of Americans have actually faced fees or needed to take in the cost of losses when taking a trip without travel insurance.

Little Known Questions About Insurance.

Trip cancellation or journey disruption coverage might be nullified if you're taking a trip to an area that's know to have actually been affected by a severe weather event such as a storm or earthquake. Luggage and also personal impacts insurance coverage safeguards shed, stolen, or damaged valuables throughout a trip. insurance. It may consist of protection throughout travel to as well as from a location.

Medical protection can aid with medical costs, aid to locate physicians as well as medical care centers, and even aid in obtaining foreign-language services. Similar to other plans, insurance coverage will differ by rate and provider. Some might cover airlift traveling to a medical facility, expanded remain in foreign healthcare facilities, and also clinical discharge to obtain treatment.

government prompts Americans to consult their medical insurance coverage carriers prior to taking a trip to figure out whether a plan prolongs its coverage outside the country, as the federal government does not guarantee residents or pay for medical expenditures sustained abroad. Clinical insurance coverage may cover the guaranteed in the United state and Canada, yet not in Europe.

Insurance - Questions

If you have Medicare or Medicaid, realize that they typically do not cover clinical expenses overseas. Before purchasing a plan, it is crucial to check out the plan arrangements to see what exclusions, such as preexisting clinical conditions, use as well as not assume that the brand-new protection mirrors that of an existing strategy.